Canada’s Economy Surges With Unexpected 2.6% GDP Growth

In a welcome and robust turn of events, the Canadian economy has demonstrated significant resilience, expanding at an annualized rate of 2.6% in the fourth quarter of 2023. This performance handily surpassed the modest 1.2% growth forecast by economists and the Bank of Canada’s own projections, sending a wave of cautious optimism across financial markets. The stronger-than-expected data, released by Statistics Canada, paints a picture of an economy that is navigating high interest rates with more vigor than anticipated, fueled by a surprising rebound in exports and solid household spending.

This growth spurt, while positive, introduces a new layer of complexity for the Bank of Canada as it weighs its next move on interest rates. The central bank has been in a holding pattern, keeping its benchmark rate at a 22-year high of 5% to continue its fight against inflation. The latest GDP figures suggest the economy may have more underlying momentum, potentially influencing the timeline for future rate cuts.

Breaking Down the Drivers of Growth

The headline annualized growth rate of 2.6% tells only part of the story. A deeper dive into the components of Gross Domestic Product (GDP) reveals the specific sectors that provided the thrust for this quarterly surprise.

A Powerful Export Engine

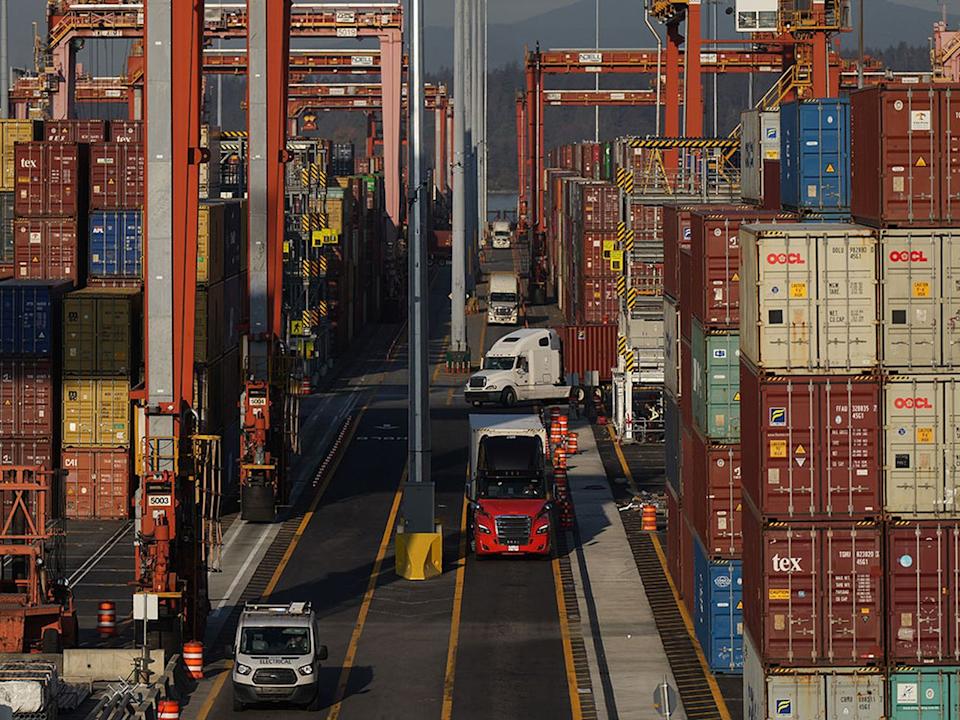

The most significant contributor to fourth-quarter growth was a substantial rise in exports. After a sluggish period, exports of goods and services surged by 1.4% for the quarter, with crude oil and bitumen leading the charge. This uptick was largely driven by increased production and delivery, highlighting the continued importance of Canada’s resource sector. The export rebound added a full percentage point to the overall GDP growth, underscoring its critical role.

Resilient Consumer Spending

Despite the financial pressure of elevated inflation and borrowing costs, Canadian households continued to open their wallets. Final domestic demand, a key measure of spending by consumers, businesses, and governments, grew by 0.7%. Notably, household spending rose by 0.2%, with increased expenditure on both goods and services. Spending on new cars was a particular bright spot, even as the high cost of servicing mortgages continued to weigh on disposable income.

Business Investment and Inventories

The business investment landscape was mixed. While spending on machinery and equipment declined, there was a notable uptick in non-residential structures, such as engineering projects. Furthermore, businesses ramped up their inventory accumulation, which also contributed positively to the GDP calculation. This buildup suggests that companies may be anticipating future demand, a sign of underlying business confidence.

Contrasting Signals and Economic Headwinds

While the quarterly data was strong, it’s crucial to view it within the broader context. The economy is still sending mixed signals, and several headwinds persist.

Per-Capita Recession Continues: Perhaps the most telling indicator of economic strain is that GDP per capita declined for the fifth consecutive quarter. With population growth at multi-decade highs, the economic pie is being divided among more people, meaning the average individual is not feeling the benefits of the headline growth number. This continues to squeeze household finances.

Interest Rate Drag is Real: The impact of the Bank of Canada’s aggressive rate-hiking cycle is evident. Investment in housing continued to contract, falling by 0.4% in Q4. The cost of servicing debt is consuming a larger share of income, which will continue to dampen spending power for many Canadians.

December Slowdown: The strong quarterly figure was also tempered by a weak monthly performance to close out the year. Preliminary data suggests the economy flatlined in December with 0.0% growth, and early estimates for January point to only a meager 0.4% increase. This indicates momentum may have slowed sharply as the quarter ended.

What This Means for Interest Rates and the Bank of Canada

This GDP report presents a classic “good news is bad news” scenario for monetary policy. The Bank of Canada’s primary mandate is to maintain price stability, and it has been clear that it needs to see sustained evidence that inflation is on a sure path back to its 2% target before it can consider cutting interest rates.

The unexpected economic strength complicates that narrative. Governor Tiff Macklem and his team will be concerned that strong demand could reignite inflationary pressures, especially in the services sector where price growth remains sticky. The bank will be scrutinizing upcoming inflation, jobs, and wage data even more closely.

Most analysts believe this report likely delays the timeline for the first rate cut. While a cut at the next meeting in March was already considered unlikely, the robust Q4 growth pushes expectations further into the second half of 2024. The central bank will want to ensure this growth is not a one-off surprise but part of a trend that could jeopardize its inflation fight.

Sectoral Spotlight: Winners and Watch Areas

The growth was not evenly distributed. Key sectors that outperformed include:

Areas that continued to struggle or contract:

Looking Ahead: Cautious Optimism for 2024

The Canadian economy has entered 2024 on a firmer footing than anyone predicted just a few months ago. The surprise 2.6% expansion proves the economy retains a core of resilience. However, the path forward is fraught with uncertainty.

The Bank of Canada now walks a finer line. It must balance the need to extinguish inflation completely against the risk of over-tightening and causing unnecessary economic pain. For Canadian households and businesses, the message is one of continued caution. While a recession may have been avoided for now, the per-capita decline and high cost of living mean the economic challenges are far from over.

The coming months will be critical. All eyes will be on whether consumer spending can hold up, if exports can maintain their momentum, and most importantly, whether inflation continues its downward trajectory. For now, Canada’s economy has earned a moment of applause for its unexpected strength, but the final grade for 2024 is still very much unwritten.